Double declining method calculator

Use this calculator to calculate the accelerated depreciation by Double Declining Balance Method or 200 depreciation. The following methods are used.

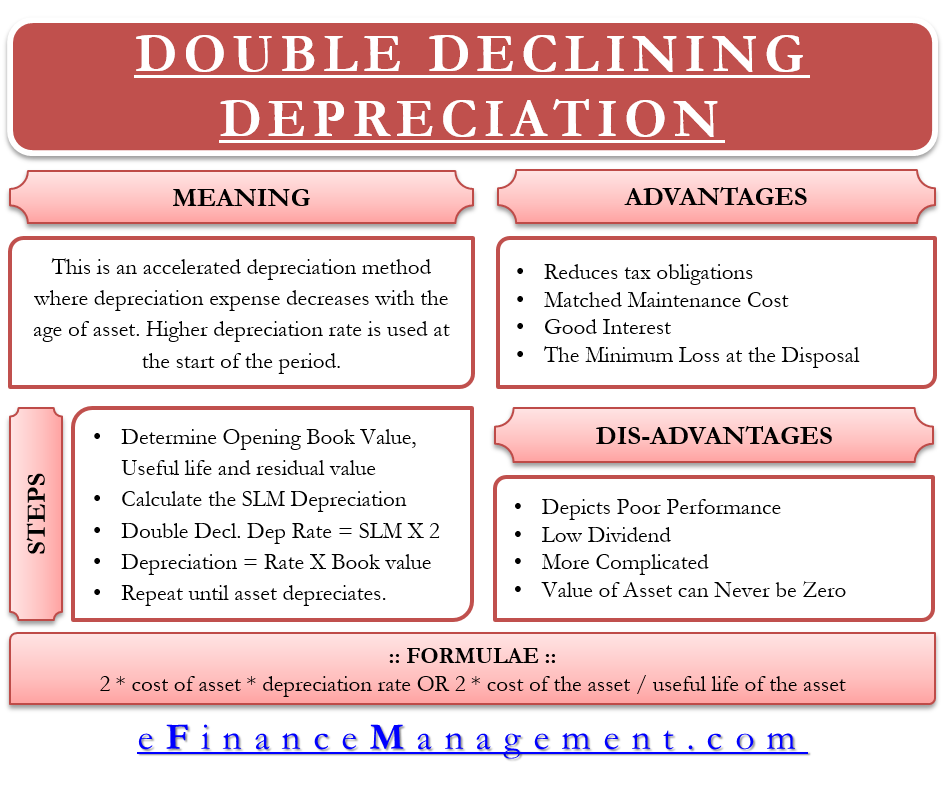

Double Declining Depreciation Efinancemanagement

Subsequent years depreciation expense book value 40.

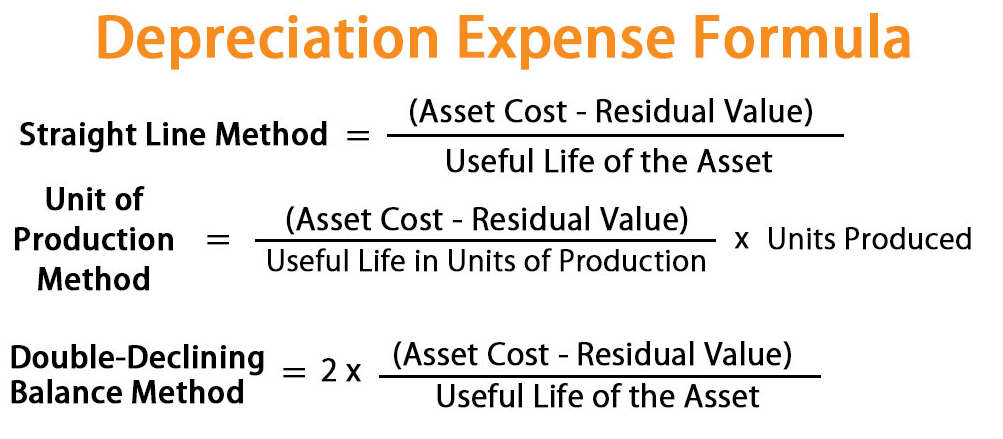

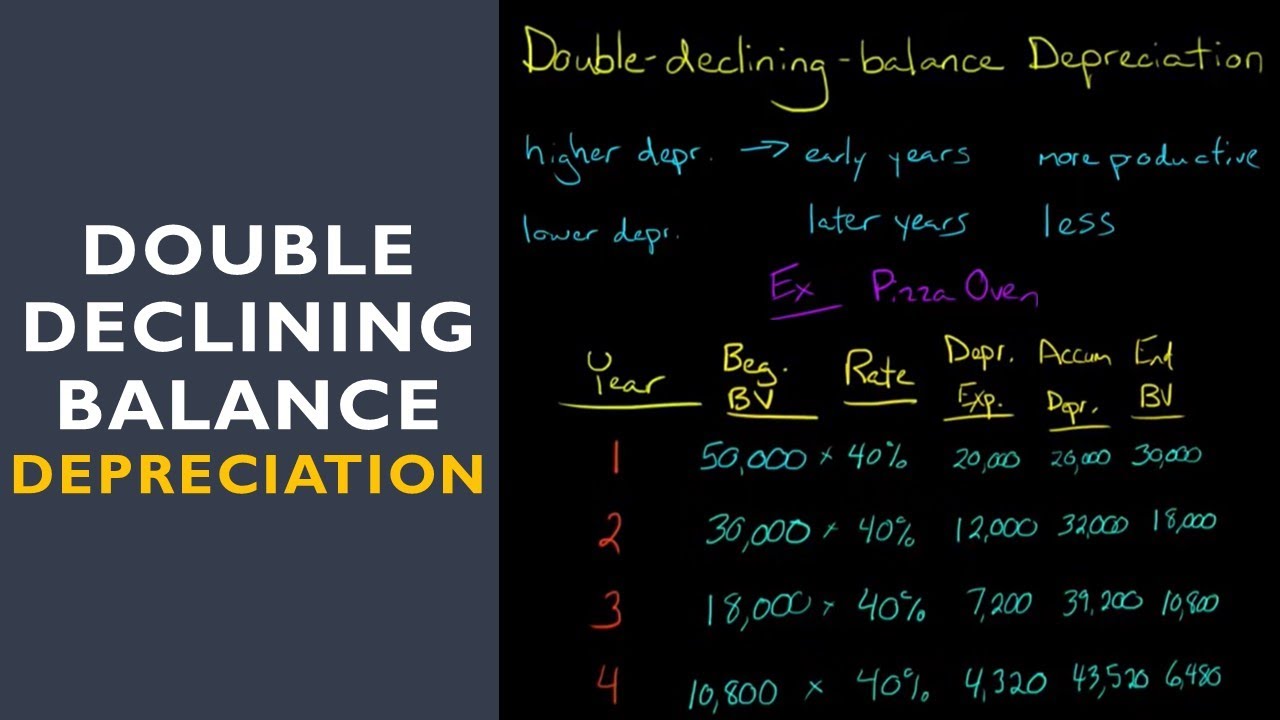

. Double Declining Balance Depreciation Method. There are several steps to calculating a double-declining balance using the following process. If we want to calculate the basic depreciation rate we can apply two formats.

Double Declining Balance Method formula 2 Book Value of. Depreciation rate in the double-declining balance can be calculated by using the straight-line to multiply with the 2. For other factors besides double use the Declining Balance Method.

Double declining balance depreciation is an accelerated depreciation method that charges twice the rate of straight-line deprecation on the asse ts carrying value at the start of each. 1st year depreciation expense 10000 x 20 2000. Assuming an asset has a life of five years and the declining balance rate is 150 percent the accelerated depreciation rate is 30 percent which is 100 percent divided by 5 multiplied by 15.

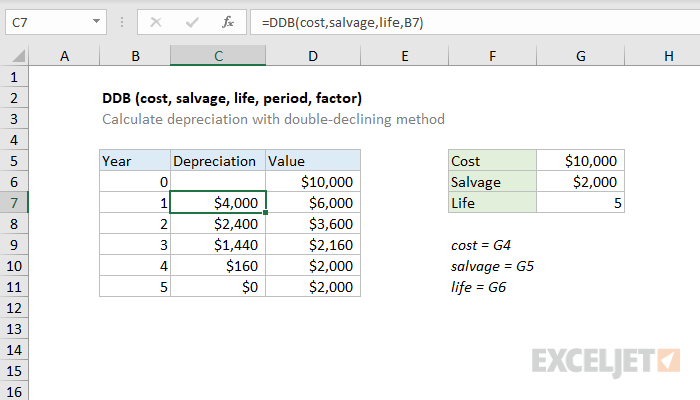

The Excel double declining balance depreciation calculator available for download below is used to compute double declining balance depreciation by entering details relating to. The double declining balance depreciation method is a form of accelerated depreciation that doubles the regular. The following calculator is for depreciation calculation in accounting.

Divide the basic annual write-off by the assets cost. The formula for depreciation under the double-declining method is as follows. Formula for Double Declining Balance Method.

Multiply the result by. It takes the straight line declining balance or sum of the year digits method. The double declining balance depreciation method is one of two common methods a business uses to account for the.

If necessary adjust depreciation expense to. If you are using the double declining. Each year multiply the assets book value at the beginning of the year by the depreciation rate to determine the depreciation.

Net book value Cost of fixed asset Accumulated depreciation. Calculate the yearly depreciation expense. MACRS depreciation calculator helps to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS.

Determine the initial cost of the asset at the time of purchase. What is the Double Declining Balance Depreciation Method. The double Declining Balance Method is one of the accelerated methods used for the calculation of the depreciation amount to be charged in the income statement of the company and it is.

Depreciation Formula Examples With Excel Template

How To Use The Excel Ddb Function Exceljet

Double Declining Balance Depreciation Calculator

Double Declining Balance Depreciation Daily Business

Double Declining Balance Calculator For Depreciating Assets

Depreciation Calculator Property Car Nerd Counter

Double Declining Balance A Simple Depreciation Guide Bench Accounting

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping

Straight Line Depreciation Calculator Double Entry Bookkeeping

Double Declining Depreciation Calculator 100 Free Calculators Io

Double Declining Balance Depreciation In Excel 2020 Youtube

Double Declining Balance Method Of Deprecitiation Formula Examples

Double Declining Depreciation Calculator Efinancemanagement

Double Declining Balance Depreciation Calculator Double Entry Bookkeeping

What Is The Double Declining Balance Depreciation Method Quora

Depreciation Formula Examples With Excel Template

Finance In Excel 6 Calculate Double Declining Balance Method Of Depreciation In Excel Youtube